Cheapest car insurance Chicago

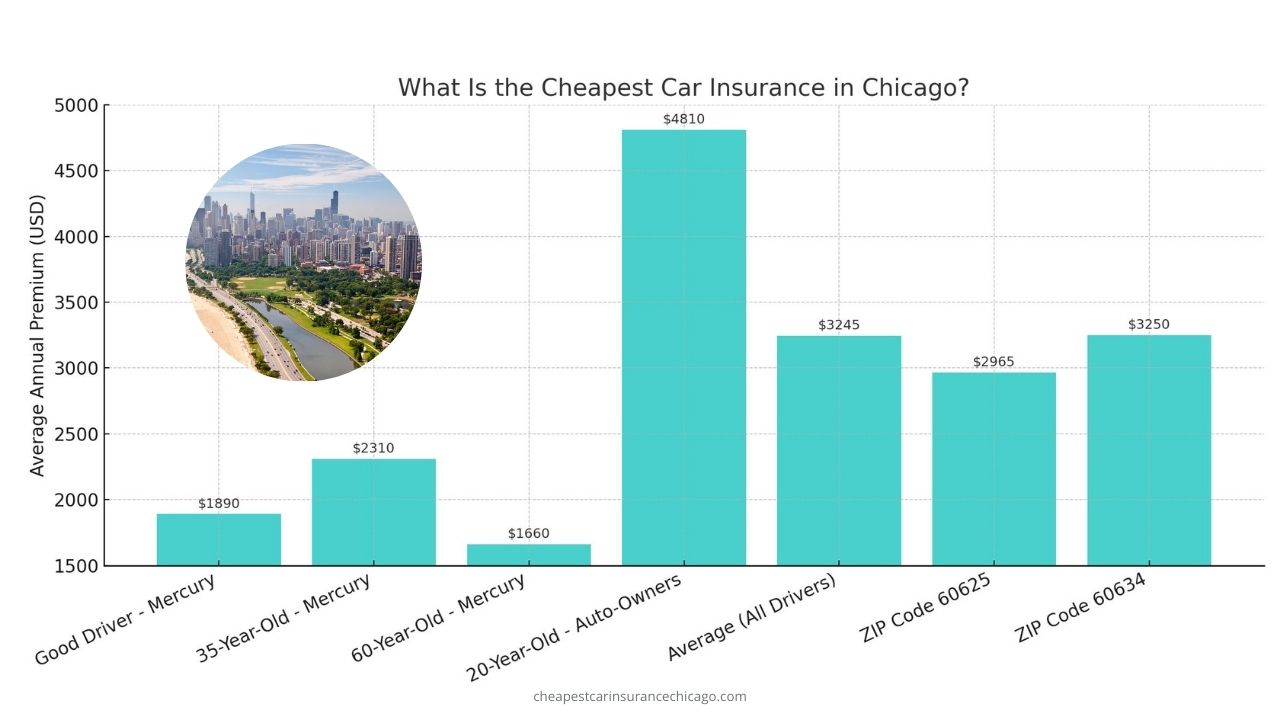

When it comes to finding the cheapest car insurance in Chicago, many drivers are surprised to learn just how much prices can vary depending on the company you choose. On average, full coverage car insurance in Chicago costs around $3,150 per year, but with a little research, you can find significantly lower rates.

The biggest factor influencing your premium often isn’t your driving record or the type of car you drive—it’s which insurance provider you go with. That’s why comparing quotes from multiple companies is key to making sure you’re getting the best possible deal.

Use our smart comparison tool to instantly find the cheapest car insurance in Chicago based on your specific needs.

Just enter a few details about your vehicle and coverage preferences, and we’ll show you the best deals available—fast, easy, and tailored for you.

Cheapest car insurance companies in Chicago 2025

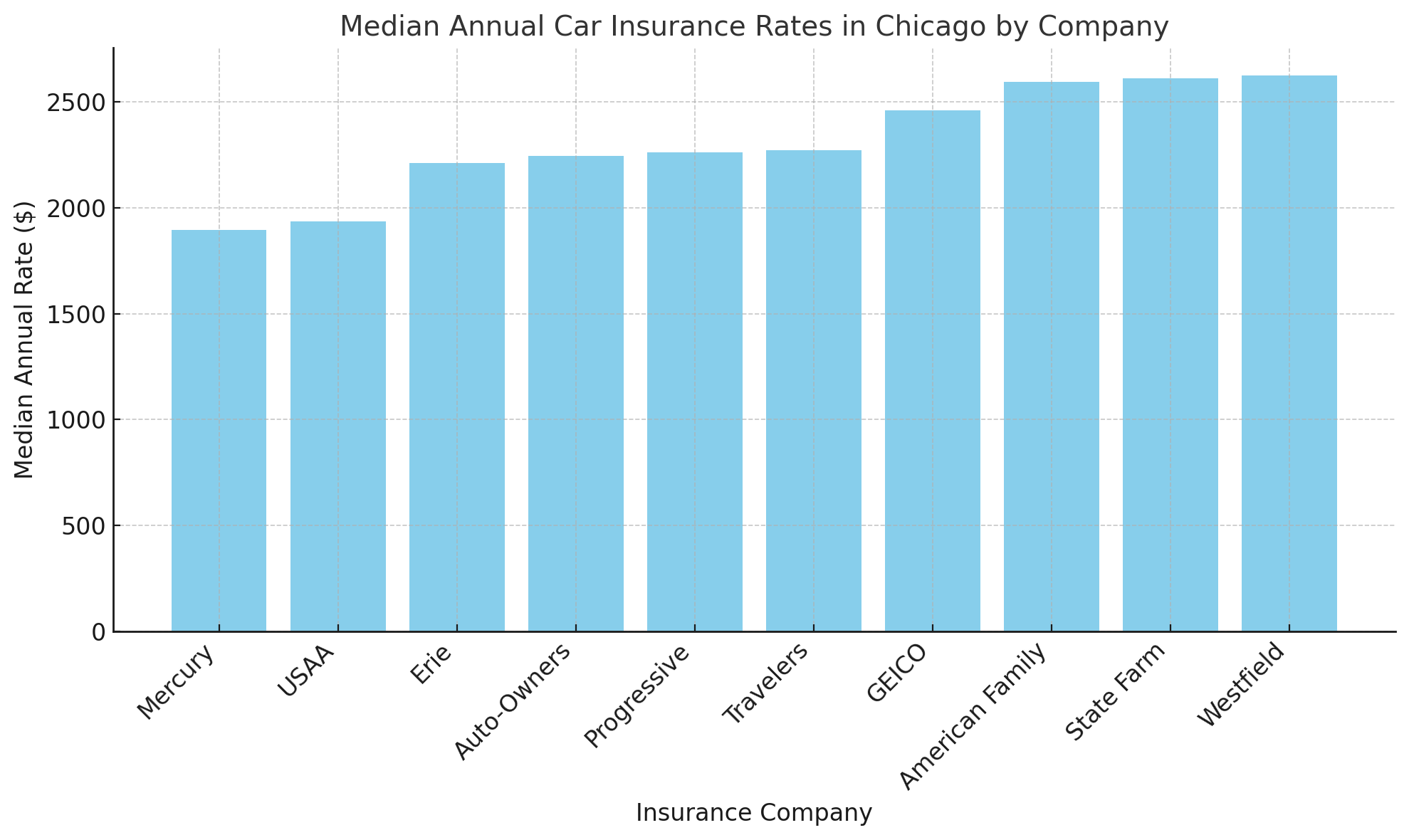

If you're looking for affordable car insurance in Chicago, several companies consistently offer lower-than-average rates—especially for drivers around 35 years old with good credit and a clean driving history.

While individual rates will vary based on your unique profile, here are some of the most budget-friendly providers based on recent data.

Mercury leads the way with a median annual rate of approximately $1,895, making it one of the most cost-effective choices in the city.

Close behind is USAA, with an average yearly premium of about $1,935—though it’s only available to military members, veterans, and their families.

Other competitive insurers include Erie at $2,210, Auto-Owners around $2,245, and Progressive, offering rates near $2,260. Travelers and GEICO follow with premiums around $2,270 and $2,460 respectively.

Rounding out the list are American Family ($2,595), State Farm ($2,610), and Westfield ($2,625), which remain solid options depending on your coverage needs.

Keep in mind, the cheapest insurer for one person may not be the cheapest for another, so it pays to compare personalized quotes.

Use our smart tool to quickly compare car insurance rates from these and other top companies—tailored to your car, driving history, and coverage preferences. Find your best rate in just minutes!

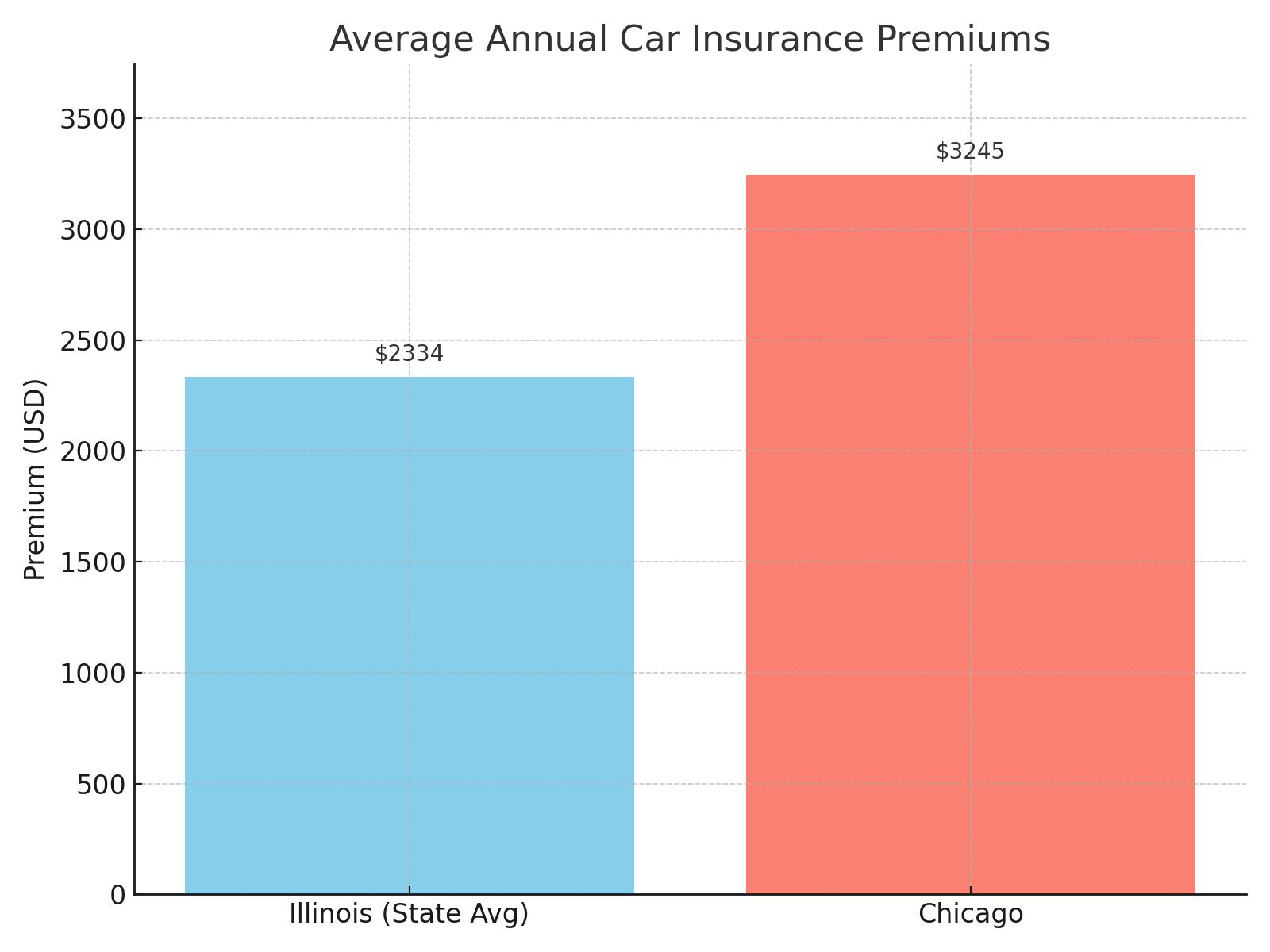

Average car insurance cost in Chicago and Illinois 2025

Car insurance costs can vary significantly depending on where you live—and that’s especially true when comparing Chicago to the rest of Illinois.

While the average annual premium across Illinois is around $2,334, drivers in Chicago pay noticeably more, with an average rate of about $3,245 per year.

Why the big difference? Several factors contribute to higher insurance costs in the city. Chicago’s dense traffic, higher rates of accidents, urban congestion, and vehicle theft risk all play a role in driving up premiums.

The condition of roads, frequency of claims in the area, and even severe weather patterns—like heavy snowfall or icy streets—can impact how much insurers charge.

On top of that, urban areas typically have higher repair costs and more expensive medical claims, which insurers factor into pricing.

Meanwhile, drivers in smaller towns or rural parts of Illinois often benefit from lower risk exposure, leading to more affordable coverage.

Understanding these regional differences is key when shopping for insurance. That’s why it's always a good idea to compare quotes based on your exact ZIP code rather than statewide averages.

Want to see how your rate compares? Try our free tool to check personalized quotes based on your location and driving history—it only takes a minute to find out if you’re overpaying.

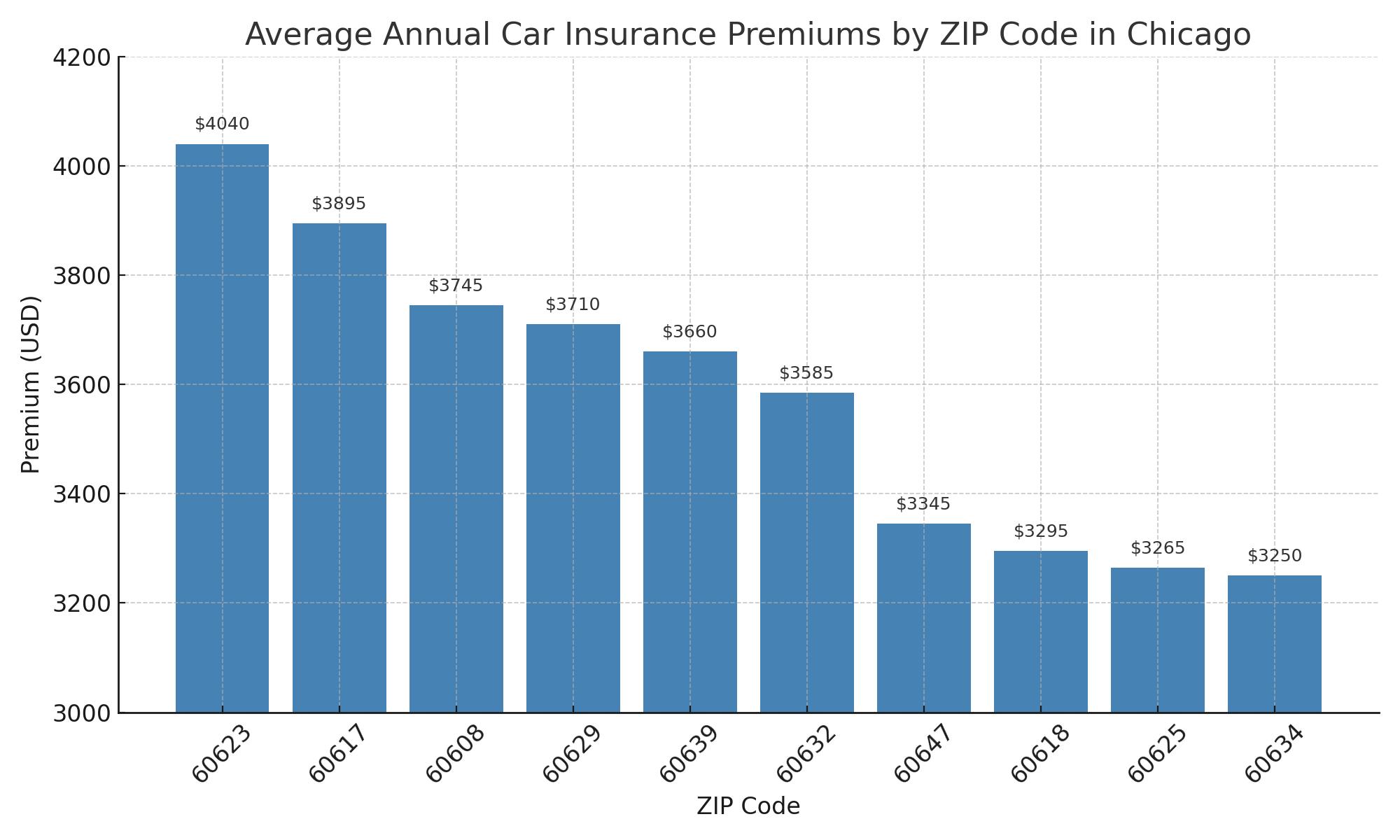

Average Car Insurance Rates in Chicago by ZIP Code

Car insurance rates in Chicago can differ quite a bit depending on the ZIP code you live in. Even neighborhoods just a few miles apart can have drastically different premiums.

This is because insurers consider local factors like accident frequency, traffic congestion, vehicle theft rates, and even repair costs when setting prices. So, while your driving record and credit score matter, your location plays a big role too.

According to recent data, some of the city’s most populated ZIP codes show how wide the price range can be. For example, drivers living in ZIP code 60623 pay some of the highest rates, with an average annual premium of about $4,040.

Meanwhile, areas like 60634 and 60625 are on the lower end, with average rates around $3,250 and $3,265, respectively.

Here’s a look at the average annual car insurance costs by ZIP code for a 35-year-old driver with good credit and a clean driving record:

60623 – $4,040

60617 – $3,895

60608 – $3,745

60629 – $3,710

60639 – $3,660

60632 – $3,585

60647 – $3,345

60618 – $3,295

60625 – $3,265

60634 – $3,250

As you can see, living in certain parts of the city could cost you hundreds more per year—even with a spotless record.

Want to know what your ZIP code’s best rate looks like? Use our smart tool to get personalized quotes in seconds and make sure you’re not overpaying.

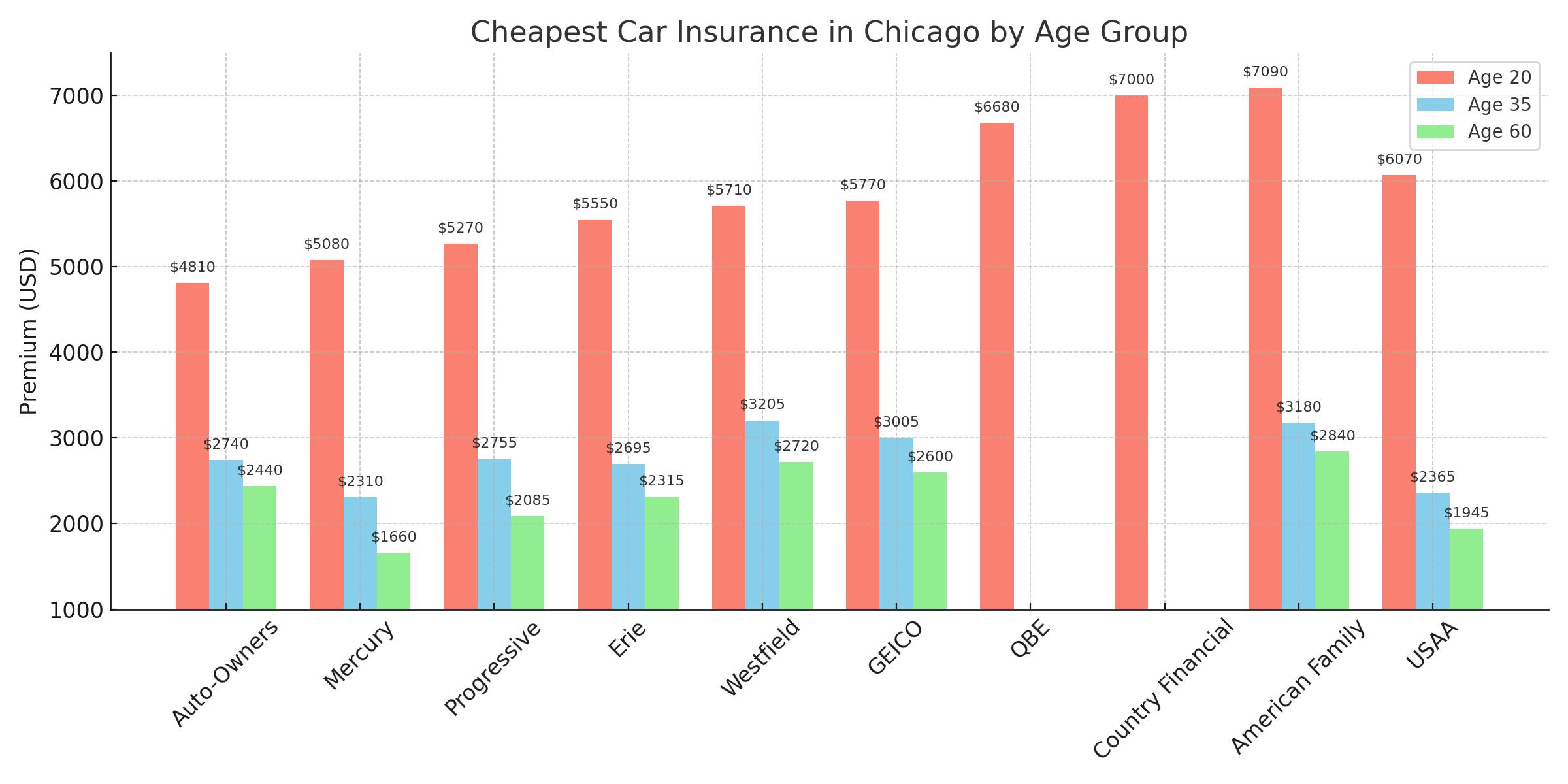

Cheap car insurance in Chicago by age

Your age plays a major role in how much you’ll pay for car insurance in Chicago—right alongside your ZIP code, driving record, and credit history. In general, younger drivers pay more, since they’re statistically more likely to be involved in accidents.

As you get older and gain more experience behind the wheel, your rates typically decrease—assuming you maintain a clean record.

It’s also worth noting that the cheapest insurance company for you at 20 may not be the same at 35 or 60, so it’s smart to compare quotes as you age. Here’s a breakdown of the average annual premiums by age group in Chicago, based on recent analysis.

Cheapest Car Insurance for 20-Year-Olds in Chicago

Drivers in their early 20s are still considered relatively high-risk, which means higher insurance premiums, even with a clean record. Here’s what 20-year-olds in Chicago can expect to pay on average per year:

Auto-Owners – $4,810

Mercury – $5,080

Progressive – $5,270

Erie – $5,550

Westfield – $5,710

GEICO – $5,770

QBE – $6,680

Country Financial – $7,000

American Family – $7,090

USAA* – $6,070

Cheapest Car Insurance for 35-Year-Olds in Chicago

By the time you’re 35, you’ve likely built a solid driving history—resulting in significantly lower rates. This is a great age to compare and potentially switch providers to lock in better deals.

Mercury – $2,310

Erie – $2,695

Auto-Owners – $2,740

Progressive – $2,755

Travelers – $2,775

GEICO – $3,005

American Family – $3,180

State Farm – $3,195

Westfield – $3,205

USAA* – $2,365

Cheapest Car Insurance for 60-Year-Olds in Chicago

At age 60, drivers with clean records typically enjoy the lowest insurance rates of their lives. Many have decades of driving experience, making them low-risk in the eyes of insurers.

Mercury – $1,660

Progressive – $2,085

Erie – $2,315

Auto-Owners – $2,440

Travelers – $2,545

GEICO – $2,600

Westfield – $2,720

Auto Club Group – $2,795

American Family – $2,840

USAA* – $1,945

No matter your age, the best way to save is to shop around regularly and compare quotes.

Use our smart comparison tool to instantly find the most affordable car insurance options in Chicago, personalized to your age and driving profile. It only takes a minute to uncover how _much you could be saving.

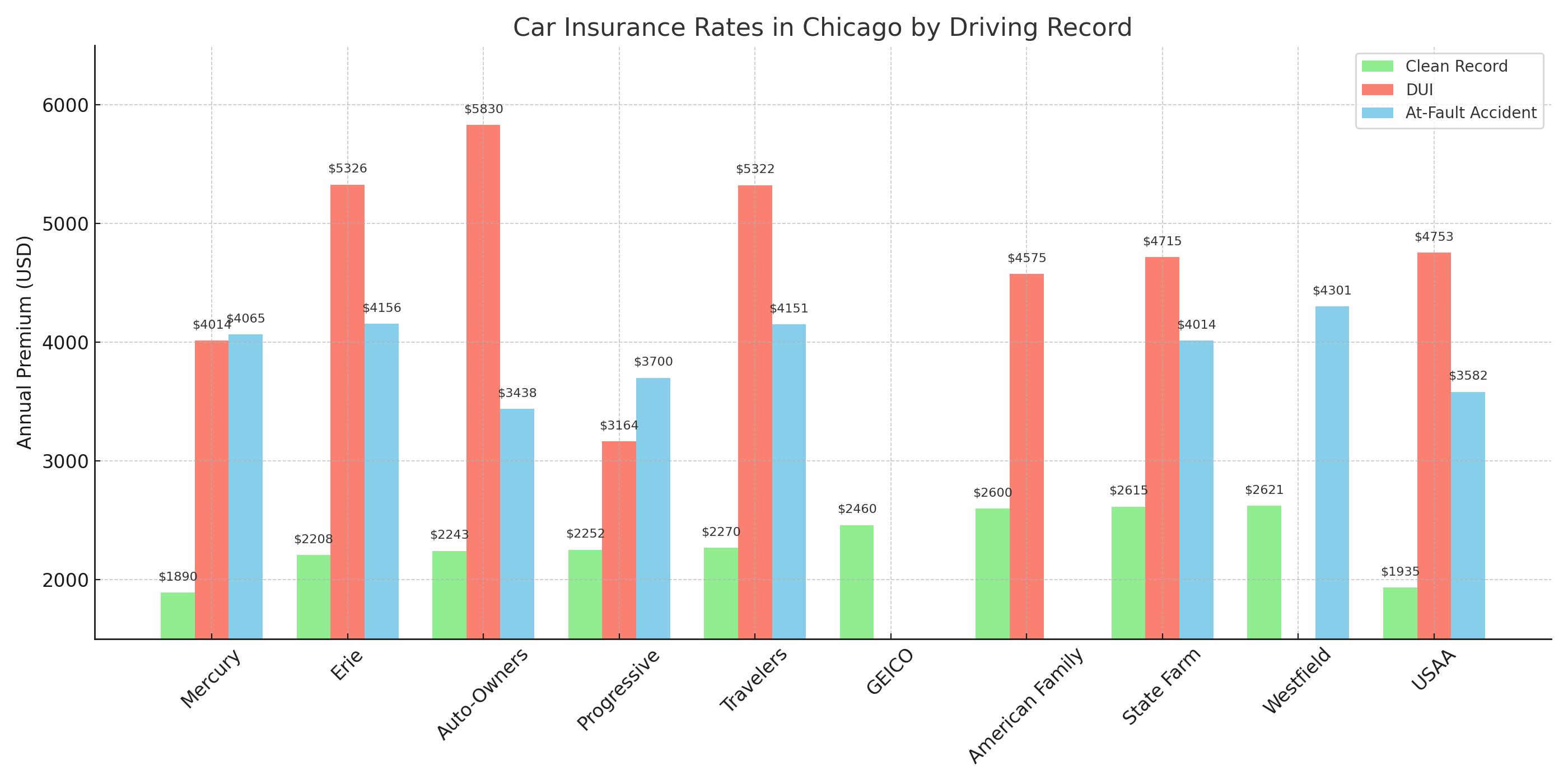

Chicago’s cheapest companies and rates by driving record

Your driving history is one of the most important factors in determining how much you’ll pay for car insurance in Chicago. Drivers with clean records typically pay much less than those who have had accidents, speeding tickets, or other violations. Since rates can vary by company, it's always smart to shop around to find the best deal for your specific situation.

Cheapest Rates for Good Drivers in Chicago

If you have a clean driving record, you're generally considered a low-risk driver, which means you’ll likely pay less for auto insurance. Insurers typically reward safe driving habits with lower premiums, making it a good idea to maintain a spotless record to keep your costs down.

Here’s what good drivers in Chicago might expect to pay for auto insurance annually, based on the most recent data:

Mercury – $1,890

Erie – $2,208

Auto-Owners – $2,243

Progressive – $2,252

Travelers – $2,270

GEICO – $2,460

American Family – $2,600

State Farm – $2,615

Westfield – $2,621

USAA* – $1,935

The rates listed above are for drivers with clean records. If you’ve had accidents or violations, your rates will likely be higher. However, shopping around is still the best way to find the most affordable options, as each company weighs driving history differently.

Drivers with a DUI

Drivers with a DUI on their record often face significantly higher insurance rates due to the increased risk associated with driving under the influence. As a result, finding affordable coverage can be difficult, and many drivers in this situation may need to turn to high-risk car insurance companies. Expect to pay much more than a driver with a clean record or even one with a minor traffic violation.

Here are the average rates for drivers with a DUI in Chicago:

Progressive – $3,164

Mercury – $4,014

American Family – $4,575

State Farm – $4,715

Travelers – $5,322

Erie – $5,326

Auto-Owners – $5,830

Country Financial – $5,903

Auto Club of SoCal – $6,041

USAA* – $4,753

Drivers with an At-Fault Accident

If you've had an at-fault accident on your driving record, you can expect to pay more for car insurance than a driver with a clean record, but likely less than someone with a DUI. The details of the accident, such as whether it was a minor fender bender or a more serious incident, will also affect your rate.

Here are the cheapest rates for drivers with an at-fault accident on their record in Chicago:

Hastings Mutual – $3,254

Auto-Owners – $3,438

Progressive – $3,700

State Farm – $4,014

Mercury – $4,065

Travelers – $4,151

Erie – $4,156

Westfield – $4,301

First Chicago – $4,571

USAA* – $3,582

In both cases, whether you're dealing with a DUI or an at-fault accident, it’s essential to compare rates from different insurers. Rates can vary greatly depending on the company’s approach to high-risk drivers, so it’s worth exploring your options to find the most affordable coverage.

Chicago car insurance requirements

If you're driving in Chicago, you must meet the auto insurance coverage requirements set by the state of Illinois.

Illinois law mandates that all drivers carry liability insurance, including uninsured/underinsured motorist bodily injury coverage (UMBI), with the following minimum limits:

$25,000 for bodily injury liability per person.

$50,000 for bodily injury liability per accident.

$20,000 for property damage liability per accident.

$25,000 for UMBI per person.

$50,000 for UMBI per accident.

Liability insurance covers the costs of any damages, injuries, or fatalities you cause in an accident, up to the limits specified in your policy.

Uninsured motorist coverage helps pay for injuries or damages when you're in an accident with someone who doesn't have insurance.

Underinsured motorist coverage comes into play when the driver at fault has insurance, but their coverage isn't sufficient to cover all the expenses resulting from the crash.

Personal injury protection (PIP) will pay for your medical expenses if you're injured in a car accident, regardless of who is at fault. Depending on your state, PIP may also cover:

Lost wages if you're unable to work because of injuries from the accident.

Services you can no longer perform, such as cleaning or childcare, due to your injuries.

Funeral expenses if the accident results in death.

A small death benefit as a cash payout.

While these minimum coverage requirements are enough to drive legally in Illinois, you may want to consider higher limits to better protect yourself financially.

For instance, if you're involved in an accident that causes significant damage, such as totaling someone else's vehicle, the $20,000 property damage liability limit might not be enough to cover all the costs. In such cases, you'd have to pay the difference out of pocket.

The Illinois Secretary of State randomly selects registered vehicles and asks their owners to verify insurance coverage through a questionnaire. If you fail to respond or report that you don’t have insurance, your license plates will be suspended.

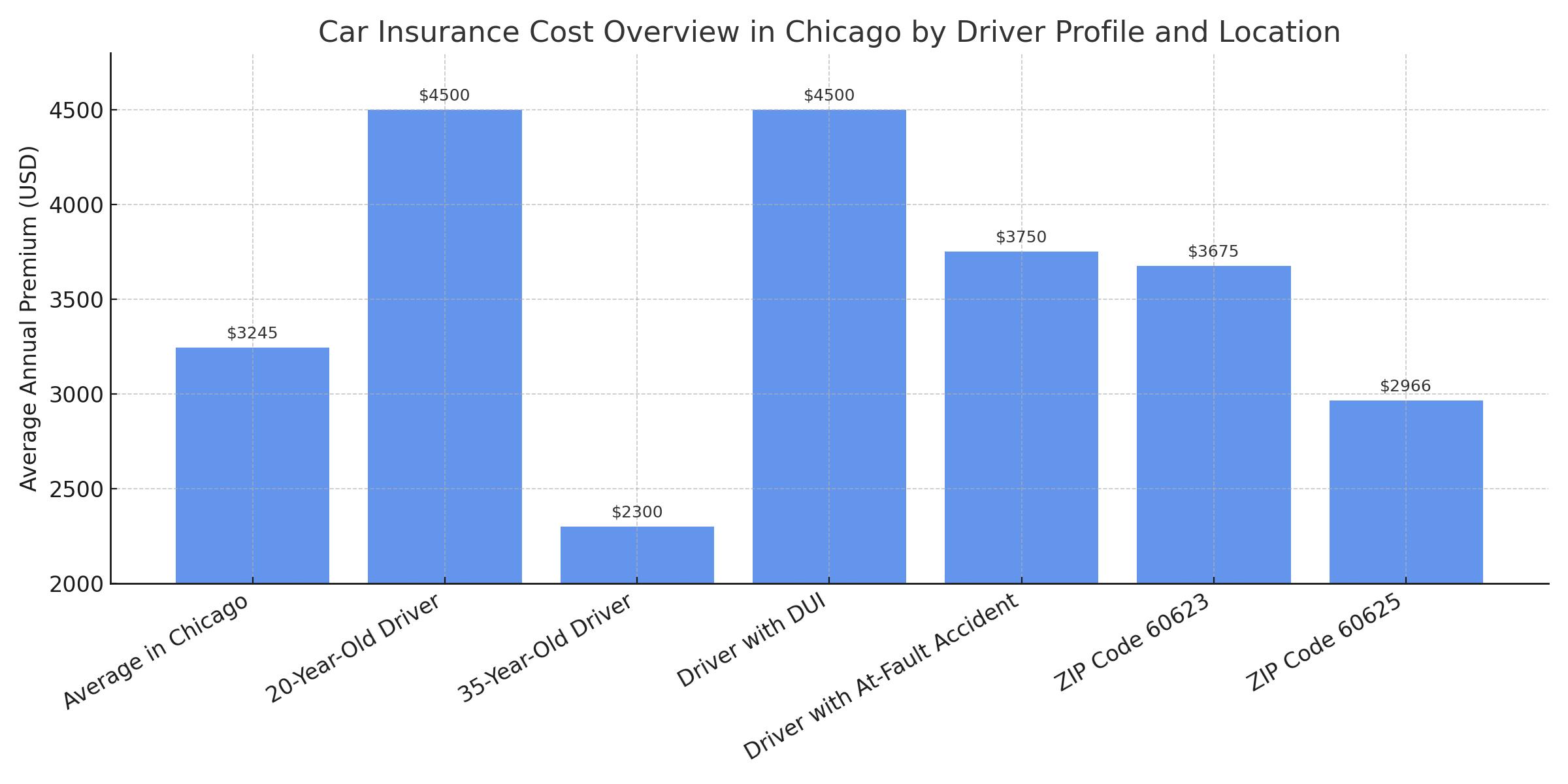

How much does car insurance cost in Chicago?

The cost of car insurance in Chicago can vary significantly depending on several factors, including where you live within the city, your driving record, age, and the type of coverage you need. On average, full coverage car insurance in Chicago costs around $3,245 per year, though this can be higher or lower based on your specific circumstances.

Age plays a major role in determining your premiums. Younger drivers, especially those in their 20s, tend to pay higher rates due to their limited driving experience and higher accident risk. For example, a 20-year-old driver might face premiums around $4,500 per year on average, while a 35-year-old driver might pay closer to $2,300 per year for similar coverage.

Your driving history is another important factor.

Drivers with a clean driving record typically enjoy lower premiums, while those with a DUI or at-fault accidents on their record can expect much higher rates. For instance, drivers with a DUI may face rates around $4,000 to $5,000 annually, while those with an at-fault accident may pay around $3,500 to $4,000.

In addition, car insurance costs in Chicago can also differ based on your ZIP code. Areas with higher rates of accidents or thefts tend to have higher premiums. For example, drivers in the 60623 ZIP code might pay an average of $3,675 per year, while drivers in the 60625 ZIP code might pay around $2,966.

To get the best deal, it's crucial to shop around and compare rates from multiple insurers. Companies like State Farm, Mercury, Progressive, and GEICO are popular in the area, but the most affordable choice for you will depend on your specific driving profile, coverage preferences, and the insurer’s rating system.

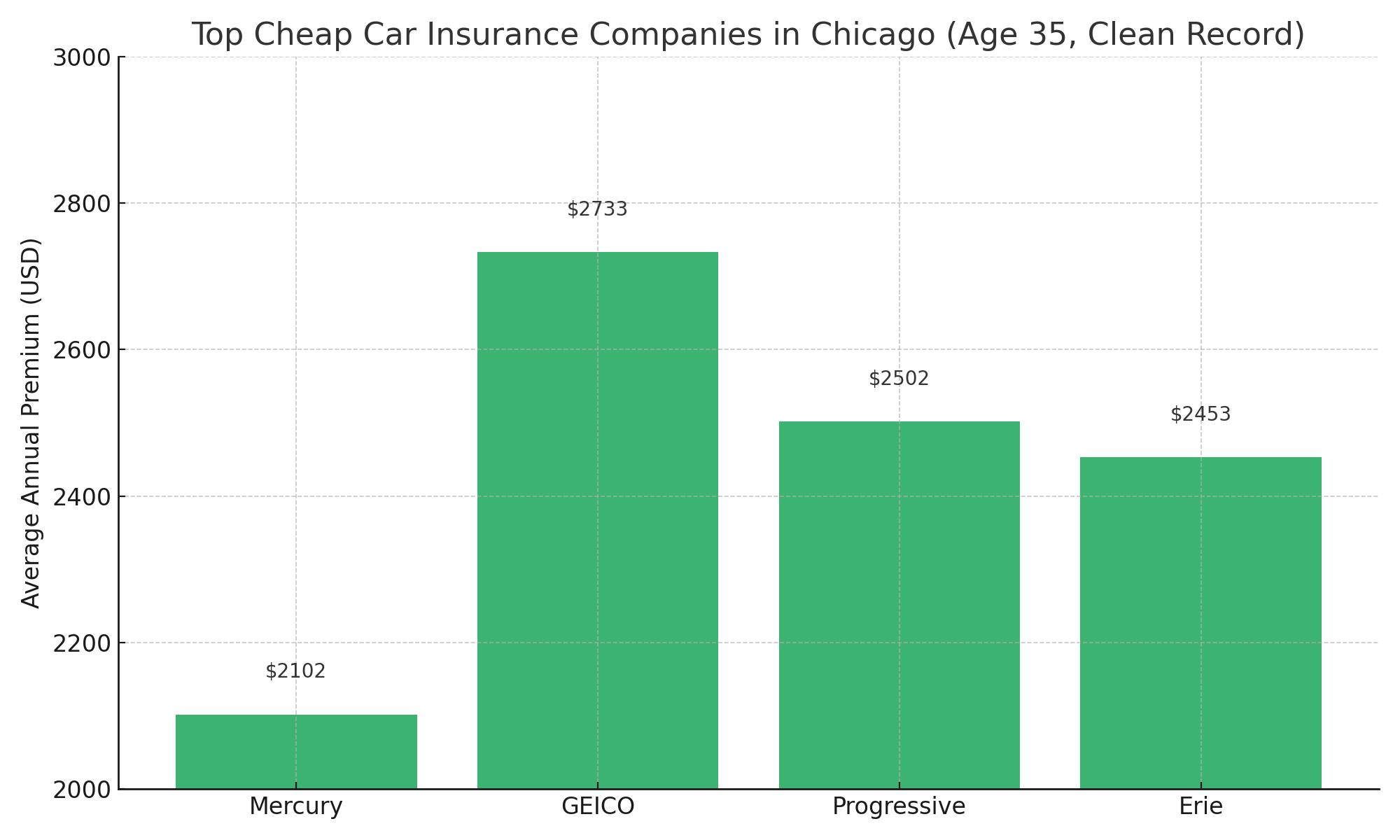

What is the #1 cheapest car insurance in Chicago?

When it comes to finding the cheapest car insurance in Chicago, the answer can vary depending on your individual circumstances, such as your driving history, age, and coverage needs. However, based on recent analysis and average rates, Mercury Insurance often stands out as one of the most affordable options for many drivers.

For instance, if you are a 35-year-old driver with a clean record, Mercury’s average annual premium in Chicago is around $2,102, making it one of the most budget-friendly options for drivers who are looking for comprehensive coverage.

Other affordable providers, depending on your profile, may include Progressive, Erie, and Auto-Owners, with rates generally ranging from $2,200 to $2,500 annually for similar coverage.

However, it’s important to note that the cheapest car insurance for you may not always be the same as for someone else. Factors such as driving violations, age, and location can all influence the rate, so it’s crucial to shop around and compare quotes from different companies to find the best deal tailored to your needs.

FAQ

Is it illegal to drive without insurance in Chicago?

Yes, driving without valid auto insurance in Chicago is illegal. Illinois law mandates that all drivers carry liability insurance, including uninsured/underinsured motorist bodily injury coverage (UMBI), with specified minimum limits.

Penalties for operating a vehicle without insurance in Illinois are significant:

First Offense: A minimum fine of $500, with potential fines up to $1,000, plus court costs. Additionally, a three-month driver's license suspension is imposed, and a $100 reinstatement fee is required to lift the suspension.

Second Offense: If convicted again while your license is already suspended for a previous insurance violation, the suspension period extends, and the reinstatement fee applies.

Third or Subsequent Offenses: Each additional violation can lead to increased fines and longer suspension periods.

It's also important to note that Illinois law enforcement agencies have access to databases that allow them to identify uninsured motorists, making it easier to enforce insurance requirements.

To avoid legal issues and ensure financial protection, it's essential to maintain valid auto insurance coverage while operating a vehicle in Chicago and throughout Illinois.

Why is car insurance so expensive in Chicago?

Car insurance in Chicago tends to be more expensive than in many other parts of the country due to several key factors:

High Population Density: Chicago is a densely populated city, and more cars on the road mean a higher likelihood of accidents, thefts, and claims. Insurance companies factor this into the cost of premiums.

Traffic and Congestion: Chicago has heavy traffic, especially during peak hours. This increases the risk of accidents, which drives up insurance rates. More vehicles and frequent stop-and-go driving create conditions where collisions are more likely.

Higher Rates of Car Theft: Urban areas like Chicago tend to experience higher rates of car theft. Insurers consider this when setting premiums, and areas with a history of theft usually see higher rates.

Cost of Repairs and Medical Care: Chicago has high costs associated with vehicle repairs and medical care in case of accidents. If an accident results in significant damages or injuries, the cost of covering these expenses can be high, leading to higher insurance premiums.

Weather Conditions: Chicago experiences severe weather, including snowstorms, hail, and ice, which can lead to more accidents and vehicle damage. This is a factor that insurers take into account when setting rates.

Insurance Fraud: Unfortunately, fraud is more prevalent in large cities, including Chicago. To offset the costs of fraudulent claims, insurers may raise rates for all drivers in the area.

State Insurance Regulations: Illinois has its own set of insurance requirements that drivers must adhere to, including minimum liability coverage and uninsured motorist protection. Meeting these requirements, especially in a high-risk area like Chicago, can contribute to higher premiums.

All these factors combine to make car insurance more expensive in Chicago compared to other areas, especially rural locations or smaller cities with fewer vehicles on the road.

Which is the best car insurance in Chicago?

The "best" car insurance in Chicago depends on several personal factors, such as your driving history, age, coverage preferences, and budget. However, some of the top car insurance companies in Chicago, known for competitive rates, solid customer service, and comprehensive coverage options, include:

1. State Farm

Best for: Wide availability, reliable customer service, and discounts.

Why it’s a top choice: State Farm is the largest car insurance provider in the U.S., and it has a significant presence in Chicago. Known for excellent customer service, a wide range of coverage options, and discounts (like safe driver and multi-policy discounts), it’s a popular choice for many.

2. GEICO

Best for: Affordable rates, especially for those with a clean driving record.

Why it’s a top choice: GEICO is known for offering competitive rates, especially for drivers who have a clean driving record. It also provides a straightforward online experience for managing policies and claims, making it a convenient choice.

3. Progressive

Best for: Drivers with specific needs or high-risk drivers.

Why it’s a top choice: Progressive is great for drivers who may need non-traditional coverage, like rideshare or umbrella insurance.

4. Mercury Insurance

Best for: Affordable rates for those with a clean driving history.

Why it’s a top choice: Mercury is known for offering competitive rates, especially for drivers in their 30s or 40s with a clean driving record. It is often one of the more affordable options in Chicago for full coverage.

5. Erie Insurance

Best for: Local service and strong customer satisfaction.

Why it’s a top choice: While not as well-known nationwide, Erie is a highly rated insurer in Chicago and Illinois for its customer service and claims handling. Erie offers competitive rates and provides a good mix of standard and optional coverage.

6. USAA

Best for: Military families.

Why it’s a top choice: If you are a member of the military, a veteran, or a family member, USAA offers excellent coverage at lower rates compared to many other providers. USAA is consistently ranked highly for customer service and claims satisfaction.

What’s the Best Car Insurance for You (Chicago) ?

If cost is your main concern, companies like GEICO and Mercury are known for offering competitive rates.

If you prioritize customer service and local presence, State Farm and Erie are solid options.

For those with a DUI or accident history, it’s essential to shop around as insurance providers have different policies for high-risk drivers.

The best car insurance for you in Chicago will ultimately depend on your specific situation, so it’s always a good idea to compare quotes and check customer reviews to find the right fit for your needs.

What is the best cheapest car insurance in Chicago?

The best and cheapest car insurance in Chicago depends on your personal circumstances, such as your age, driving history, coverage needs, and location.

However, based on various factors, such as affordability, customer satisfaction, and coverage options, here are some of the top choices for cheap car insurance in Chicago:

1. Mercury Insurance

Why it’s affordable: Mercury offers some of the most competitive rates in Chicago, especially for drivers with a clean record. It provides discounts for bundling home and auto insurance, as well as safe driving.

Average Annual Rate: Around $2,102 for a 35-year-old with a clean driving history.

Best for: Affordable full coverage with decent customer service.

2. GEICO

Why it’s affordable: GEICO is known for offering low-cost policies for safe drivers. They provide easy online quote tools and discounts, such as for good drivers, multi-car policies, and military members.

Average Annual Rate: Approximately $2,733 for a 35-year-old with a clean driving record.

Best for: Affordable rates and an excellent mobile app for managing your policy.

3. Progressive

Why it’s affordable: Progressive is often a strong option for those seeking competitive prices with great features like the Snapshot program, which rewards safe driving with discounts.

Average Annual Rate: Around $2,502 for a 35-year-old with a clean driving record.

Best for: Customizable policies with various discounts, including for safe driving and bundling.

4. Erie Insurance

Why it’s affordable: Erie offers some of the most competitive rates for drivers in the Chicago area, particularly those with a clean driving history.

Average Annual Rate: Approximately $2,453 for a 35-year-old with good credit and no accidents.

Best for: Drivers who want a balance of affordable rates and strong customer service.

5. Auto-Owners Insurance

Why it’s affordable: Auto-Owners offers affordable premiums while maintaining good customer satisfaction ratings. They are often considered a cost-effective choice

What are the requirements for auto insurance in Illinois?

In Illinois, all drivers are required to carry minimum liability insurance to legally operate a vehicle. The state sets specific requirements for the type and amount of coverage you must have. Here are the key requirements for auto insurance in Illinois:

1. Liability Insurance:

Liability insurance covers the cost of damage or injury you cause to others in an accident. The minimum coverage requirements in Illinois are:

Bodily Injury Liability:

$25,000 per person (for injuries to one person in an accident).

$50,000 per accident (for total injuries in an accident).

Property Damage Liability:

$20,000 per accident (for damage to another person's property).

2. Uninsured/Underinsured Motorist (UM/UIM) Coverage:

This covers your medical expenses and damages if you are in an accident caused by a driver who either doesn’t have insurance or doesn’t have enough insurance to cover the damages.

Uninsured Motorist Bodily Injury (UMBI):

$25,000 per person.

$50,000 per accident.

Underinsured Motorist Bodily Injury (UIMBI): This is the same as uninsured coverage, but it applies if the at-fault driver has some insurance but not enough to fully cover your expenses.

3. Personal Injury Protection (PIP) (Optional in Illinois):

Illinois does not require Personal Injury Protection (PIP) coverage, which covers medical expenses and lost wages regardless of who is at fault. However, many drivers opt to add this coverage for extra protection.

4. Proof of Insurance:

You must carry proof of insurance when driving in Illinois. If you're pulled over or involved in an accident, you may be asked to show this proof.

Electronic proof of insurance (such as a smartphone app) is accepted in Illinois, as long as it clearly shows your insurance details.

5. Penalties for Driving Without Insurance:

If you're caught driving without insurance, the penalties can be severe:

A minimum fine of $500, and it could go up to $1,000.

Your vehicle’s registration can be suspended, and you might have to pay a $100 reinstatement fee.

If you’re in an accident and don’t have insurance, you may face even harsher penalties, including liability for all damages and additional fines.

6. Insurance Requirements for Drivers Under 18:

If you are under the age of 18, you must carry the same minimum auto insurance requirements, and you may also need to show a parent or guardian's signature for insurance policies.

Optional Coverage:

While liability insurance and uninsured/underinsured motorist coverage are mandatory, drivers may choose to purchase additional coverage, including:

Comprehensive Coverage: Covers damage to your car from non-collision events, such as theft, fire, or vandalism.

Collision Coverage: Covers damage to your car resulting from a collision, regardless of fault.

Medical Payments Coverage: Pays for medical expenses for you and your passengers in the event of an accident.

Summary of Minimum Coverage in Illinois:

Bodily Injury Liability: $25,000 per person / $50,000 per accident.

Property Damage Liability: $20,000 per accident.

Uninsured/Underinsured Motorist Bodily Injury: $25,000 per person / $50,000 per accident.

To ensure you are meeting all requirements, always check with your insurance provider to confirm your coverage and make sure it aligns with Illinois state law.

What is the lowest form of car insurance in Chicago?

The lowest form of car insurance in Chicago is typically liability insurance, which is the minimum coverage required by Illinois law. It provides basic protection for damages or injuries you cause to others in an accident. However, it does not cover your own injuries or damages to your vehicle.

In Illinois, the minimum liability insurance requirements are as follows:

Minimum Liability Insurance in Illinois:

Bodily Injury Liability:

$25,000 per person for injuries in an accident.

$50,000 per accident for total injuries to all individuals in a single accident.

Property Damage Liability:

$20,000 per accident for damage to another person's property.

Why Liability Insurance is the Lowest Option:

Bodily Injury Liability covers medical costs for others when you are at fault in an accident.

Property Damage Liability covers the repair or replacement of other people's property if you're responsible for the damage.

Does Not Cover:

Your own injuries.

Damage to your own vehicle.

Injuries or damage caused by uninsured or underinsured drivers (unless you opt for additional coverage like Uninsured Motorist Insurance).

Limitations of Minimum Liability Insurance:

While liability insurance is the lowest and cheapest form of coverage, it may not provide enough protection in the event of a serious accident. For example:

If you cause significant damage or injuries to others, the minimum coverage limits may not be enough to cover the full costs, leaving you personally responsible for the remaining balance.

It doesn't cover damage to your own vehicle or your own medical bills if you're injured in an accident.

Can you self insure your car in Illinois?

Find the cheapest car insurance in Chicago, Illinois, with our easy-to-use comparison tool. Get personalized quotes from top providers and save money on reliable coverage. Whether you need basic liability or full coverage, we help you find the best rates in seconds. Start comparing now!

Can you drive without insurance in Chicago?

Find the cheapest car insurance in Chicago, Illinois, with our easy-to-use comparison tool. Get personalized quotes from top providers and save money on reliable coverage. Whether you need basic liability or full coverage, we help you find the best rates in seconds. Start comparing now!

Can you go to jail in Illinois for no auto insurance?

In Illinois, driving without car insurance is considered a petty offense and does not carry the risk of jail time. However, it does come with significant penalties, including fines and the suspension of your driving privileges.

Penalties for Driving Without Insurance in Illinois:

First Offense:

You will face a fine between $500 and $1,000.

Your driver's license and vehicle registration can be suspended for up to three months.

To get your license and registration reinstated, you’ll need to pay a $100 reinstatement fee.

Second Offense:

The fine remains the same, ranging from $500 to $1,000.

Your license and registration may be suspended for another three months.

You’ll still need to pay the $100 reinstatement fee.

Third or Subsequent Offenses:

The fine increases to at least $1,000.

Your license and registration may be suspended for up to four months.

A $100 reinstatement fee will still apply.

You may also be required to carry SR-22 insurance for three years, which proves that you have the financial means to cover potential damages.

While jail time is not a consequence of driving without insurance in Illinois, the financial and administrative penalties can be substantial. Additionally, if you're involved in an accident while uninsured, you could be held personally responsible for damages and injuries, which could lead to costly out-of-pocket expenses.

To avoid these penalties, it’s important to always have valid insurance and keep proof of coverage in your vehicle.